U.S. Tile Consumption Overview:

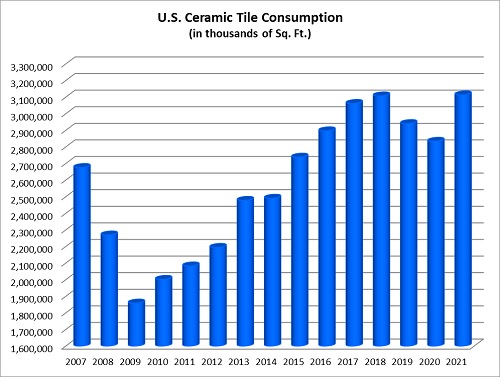

Supported by gains in the U.S. construction and housing markets and robust overall economic growth, U.S. ceramic tile consumption increased for the first time since 2018. Total U.S. ceramic tile consumption in 2021 was 3.11 billion sq. ft., up 9.9% from the previous year.

The following table shows U.S. ceramic tile shipments, imports, exports, and total consumption in thousands of sq. ft.

| Year | U.S. Shipments (incl. Exports) | Imports | Exports | Total Consumption* | Change vs. Previous Year |

| 2021 | 918,264 | 2,233,142 | 37,986 | 3,113,421 | 9.9% |

| 2020 | 898,533 | 1,966,443 | 31,009 | 2,833,967 | -3.6% |

| 2019 | 895,332 | 2,077,038 | 31,782 | 2,940,588 | -5.4% |

| 2018 | 940,300 | 2,196,935 | 29,746 | 3,107,489 | 1.5% |

| 2017 | 990,972 | 2,099,307 | 28,492 | 3,061,787 | 5.7% |

*Note: U.S. Shipments + Imports – Exports

The chart below shows total annual U.S. ceramic tile consumption in sq. ft.

U.S. Tile Consumption Overview:

U.S. imports in 2021 reached their highest level in fifteen years. The 2.23 billion sq. ft. of tile imported last year was a 13.6% increase from 2020.

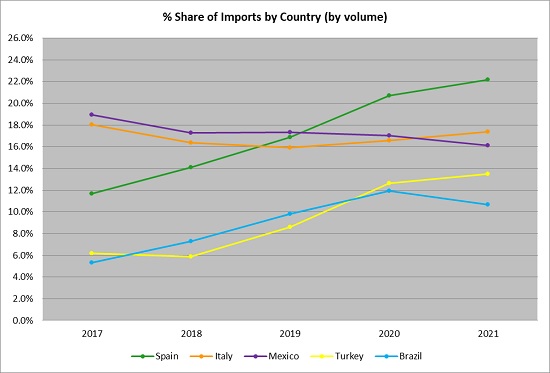

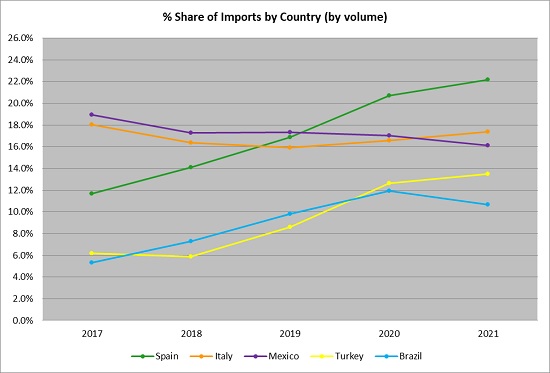

Spain, which in 2020 supplanted China as the largest exporter of ceramic tile to the U.S. by volume, maintained this position. Spanish imports held a 22.2% share of total U.S. imports by volume in 2021, up from 20.7% the previous year.

Italy was the second largest exporter to the U.S. by volume, its highest position since 2008. Italian-produced tiles made up 17.4% of the U.S. import market last year, up from 16.6% the previous year.

Mexico, which was the third largest exporter to the U.S., has seen its share of total imports fall steadily over the last decade from an all-time high of 31.5% in 2012 to 16.1% last year.

Rounding out the top five were Turkey (13.5% share) and Brazil with a 10.7% share of U.S. imports by volume.

The five countries from which the most tiles were imported in 2021 based on volume were:

| Country | Sq. Ft. 2021 | Sq. Ft. 2020 | % Change |

| Spain | 495,564,193 | 407,249,860 | 21.7% |

| Italy | 388,225,617 | 325,939,270 | 19.1% |

| Mexico | 359,595,768 | 335,246,651 | 7.3% |

| Turkey | 300,873,685 | 248,851,082 | 20.9% |

| Brazil | 238,513,562 | 234,794,244 | 1.6% |

| All Countries | 2,233,142,091 | 1,966,443,251 | 13.6% |

On a dollar basis (CIF + duty) Italy remained the largest exporter to the U.S. making up 31.6% of 2021 U.S. imports, followed by Spain (25.3% share) and Mexico (9.8% share).

The five countries that exported the most tiles to the U.S. in 2021 based on total U.S. $ value (CIF + duty) were:

| Country | Total $ Val 2021 | Total $ Val 2020 | % Change |

| Italy | 790,675,424 | 628,564,234 | 25.8% |

| Spain | 633,944,124 | 468,556,063 | 35.3% |

| Mexico | 244,896,355 | 223,989,682 | 9.3% |

| Turkey | 227,643,808 | 187,703,524 | 21.3% |

| Brazil | 171,157,677 | 150,568,515 | 13.7% |

| All Countries | 2,502,773,371 | 2,002,787,363 | 25.0% |

The average values of tile (including CIF + duty) from the five countries that exported the most tiles to the U.S. in 2021 based on volume were:

| Country | Sq. Ft. 2021 | Tot Val 2021 | Val/Sq. Ft. 2021 | Val/Sq. Ft. 2020 |

| Spain | 495,564,193 | 633,944,124 | $1.28 | $1.15 |

| Italy | 388,225,617 | 790,675,424 | $2.04 | $1.93 |

| Mexico | 359,595,768 | 244,896,355 | $0.68 | $0.67 |

| Turkey | 300,873,685 | 227,643,808 | $0.76 | $0.75 |

| Brazil | 238,513,562 | 171,157,677 | $0.72 | $0.64 |

| All Countries | 2,233,142,091 | 2,502,773,371 | $1.12 | $1.02 |

The average value is significantly affected by the mix of tiles imported, with different types of tiles impacting the average value, in addition to differences in pricing for the same types of tile.

U.S. Shipments:

U.S. manufacturers shipped 880.3 million sq. ft. of ceramic tile domestically last year, a 1.5% increase from 2020.

Though imports’ share of U.S. consumption grew from 69.4% in 2020 to 71.7% last year, domestically-produced tiles’ share of consumption (28.3%) remained far ahead of all other individual countries exporting tile to the U.S., with the nearest being Spain (15.9% of U.S. tile consumption), Italy (12.5%), and Mexico (11.5%).

In dollars, 2021 U.S. FOB factory sales of domestic shipments were $1.36 billion, a 5.0% increase from 2020. U.S. shipments comprised 35.2% of 2021 total U.S. tile consumption by value, down from 39.3% the previous year.

The per unit value of domestic shipments increased from $1.49/sq. ft. in 2020 to $1.54/sq. ft. last year.

U.S. Exports:

U.S. ceramic tile exports in 2021 were 38.0 million sq. ft., a 22.5% increase from the previous year. The two largest consumers of U.S. exports by volume were Canada (70.7%) and Mexico (14.3%).

The value of U.S. exports rose 29.8% from $31.2 million in 2020 to $40.4 million last year.

Housing Market Highlights:

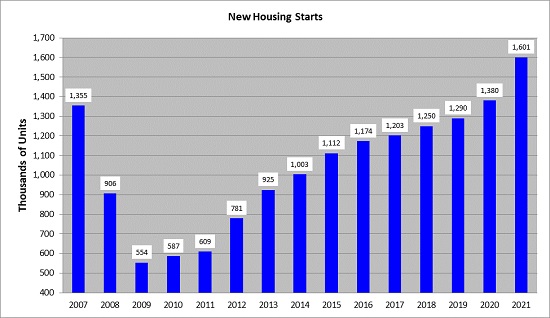

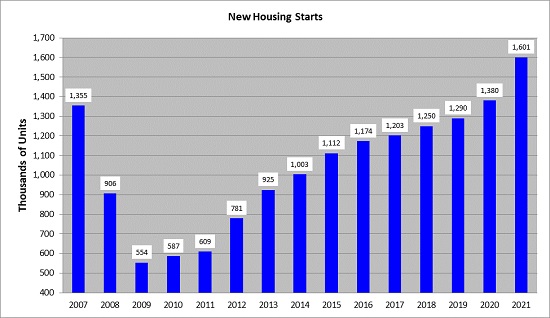

New Home Starts

In the residential market, despite supply chain and labor issues, new home starts rose for the twelfth consecutive year and were at their highest point since 2006. The 1.60 million units started in 2021 represented a 16.0% increase from the previous year.

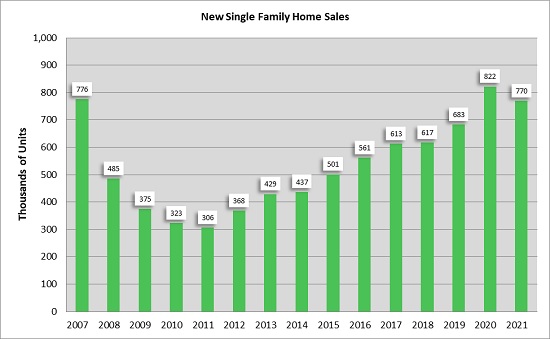

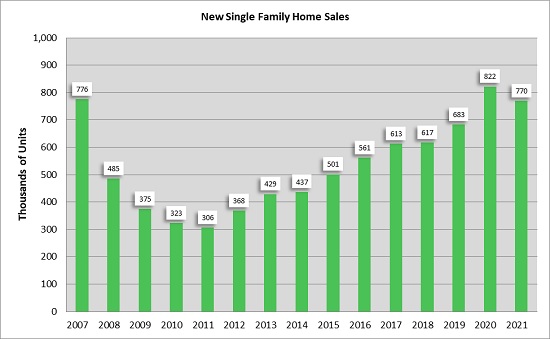

New Single-Family Home Sales

With record-high average new home prices and a low supply of available properties, new single-family home sales fell for the first time in a decade. The 770,000 units sold in 2021 represented a 6.3% decline from the previous year.

About Tile Council of North America (TCNA)

TCNA is a trade association representing manufacturers of ceramic tile, tile installation materials, tile equipment, raw materials and other tile-related products. Established in 1945 as the Tile Council of America (TCA), it became the Tile Council of North America (TCNA) in 2003, reflecting its membership expansion to all of North America.

The Tile Council is recognized for its leadership role in facilitating the development of North American and international industry quality standards to benefit tile consumers. Additionally, TCNA regularly conducts independent research and product testing, works with regulatory, trade, and other government agencies, and publishes installation guidelines, tile standards, economic reports, and promotional literature.