The following article provides a brief high-level summary of the construction outlook for both the residential and commercial markets, including an estimate of tile consumption for 2022 based upon outlook and conditions as of December 2021. Forecasting estimates for 2022 are significantly challenged by unprecedented supply chain and freight uncertainty, which create excessive inflationary pressures, plus the continued impact of COVID on global economic activity.

Residential construction

Residential new and remodeling construction has always and continues to account for a significant share of tile consumption – now slightly over 60% and a key barometer to the overall economy. This has certainly been the case in 2021, and outlook for 2022 affirms the importance of these segments to tile and stone consumption. Outlooks vary significantly from many sources, which is no surprise based on the dynamics impacting the economy. However, the key indicators point to the residential segment driving the growth of tile and stone consumption again for 2022.

• New housing starts – 2021 turned out to be another strong year for single family housing starts, once again surpassing original forecasts, and finishing up roughly over 13%. Driving this strength has been continuation of changing preference to leave densely-populated urban areas, continued work from home and more millennials starting to form families and households. In addition, mortgage rates continue to remain at historically low levels and are expected to remain so through 2022. Forecasts vary widely, however there is consensus of continued growth in single family starts in 2022 of between 2% to 5% – cooling from 2020 and 2021 due to rising material costs. This growth is still a positive forecast for tile and stone, which rely heavily on the residential market for growth. Multi-family also realized mid-teen gains, up roughly 15% versus 2020, as condo and townhouses increased in more rural areas. Forecasts for 2020 show additional growth, however, at a slower rate of less than 15%.

• Residential remodeling – continues to be the main driver of tile and stone consumption, representing between 36%-40% of total demand. 2021 saw increased activity as work-from-home and stay-at-home home improvement continued consistently. In addition, inventory of existing homes remains low/stable helping increase home values, with mortgage rates forecasted to remain at very low levels aiding in affordability for first-time buyers of new home and for confidence in remodeling investments. Current trends and forecasts point to a continuation into 2022 with moderate existing home unit sales around +3% versus 2021. This is a great indicator for bath and kitchen remodels – roughly 7 million and 5 million respective annual units for 2022. Overall current projections are for remodeling to remain healthy – increasing in a range of +6% to 9% over 2021 in total expenditures.

Commercial construction

The commercial segment slide in 2019 and 2020 finally saw a much needed reversal in 2021 in both new starts and in the remodeling sector.

There are wide-ranging estimates, however consensus of declines between -12% to -23% in overall new construction square-foot starts occurred in 2020. To no surprise, COVID shutdowns impacted every vertical negatively.

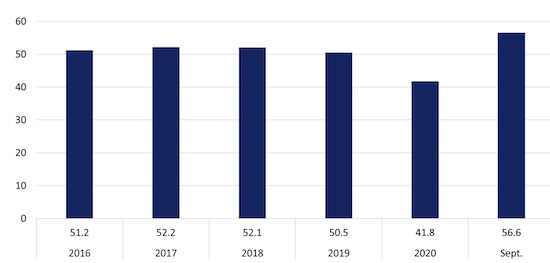

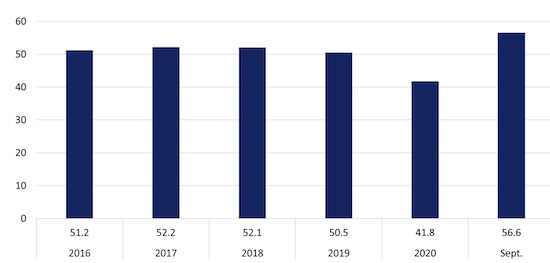

According to the AIA, billing and inquiry activity among architects has seen a nice rebound throughout 2021, across all segments to some of the highest levels since 2005. This level of activity is an excellent indicator for the segment – pretty much all verticals showing improvement over 2020. With new commercial starts, there is a 9 to 12+ month lag depending upon type of project between a start and roughly when flooring materials are utilized. This pushes the realized impact of the 2021 activity into 2022 and even into 2023. The good news is that 2021 starts for commercial construction grew at over 5% and are again forecasted to increase similarly in 2022, helping drive growth in tile and stone consumption.

Commercial additions and alterations have been able to rebound faster than new starts, in large part benefitting from the economic re-opening and rapid activity in 2021, seeing an increase of over 9% in total spend. Commercial remodeling activity is expected to increase between 8% and 10% in 2022 with growth again seen in all verticals, again with a lower lag time which will help the overall segment’s share of tile and stone consumption. Supply chain constraints and rising material costs still pose an overhanging cloud, however, institutional lending activity remains strong, providing us confidence the commercial rebound has begun.

Tile and stone consumption

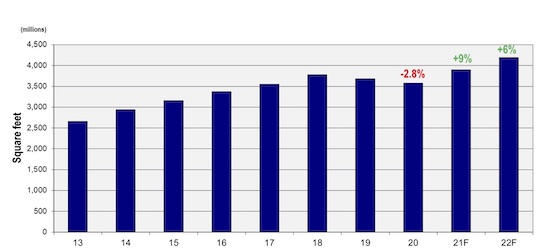

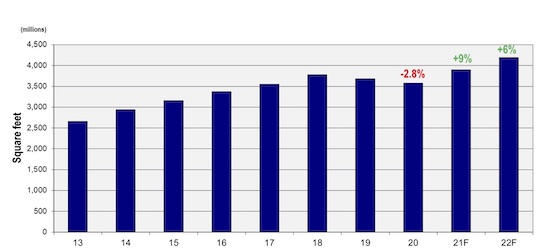

As previously mentioned, 2021 residential construction continued another strong year of growth for both new and remodeling activity, while commercial construction started its rebound as well in a headwind of supply and inflationary challenges. Based on the segments and overall macro-economic indicators, we believe tile and stone combined consumption will increase roughly between 7% and 9% to ~3.9 billion square feet in 2021.

Through an evaluation of the above forecasted growth in each market segment for 2022, we can then segment the ceramic tile and stone industry accordingly and calculate the respective share in square footage of each construction segment with applicable growth percentages based upon the 2022 outlook. At this time, an estimate range for 2022 indicates combined tile and stone consumption growth of 4% to 6% over 2021.

Tile and stone consumption estimates are naturally subjected to all the macroeconomic and subsequent construction market risks. Supply chain challenges continue to disrupt all segments and inflationary activity is unlike anything we have seen in decades. These factors significantly complicate the normal forecasting inputs. Outlooks for growth in 2022 by major construction and financial institutions remain optimistic that issues will stabilize and are projecting growth for 2022 at various rates. It is that consensus which makes us confident that we are looking forward to continued growth in tile and stone consumption, albeit at a slightly slower rate than 2021.

Sean P. Boyle

Sean Boyle is the Vice President of Market Intelligence & Channel Management at LATICRETE International, Inc.